IFC Markets

-

Trading conditions76%

-

Platforms and tools83%

-

Credibility55%

-

Education85%

-

Support60%

-

Fees and payments66%

-

Users choice0%

IFC Markets is a brokerage company providing its customers with services for trading financial instruments both on organized market places and beyond, using trading-analytical platforms NetTradeX, MetaTrader 4 and MetaTrader 5.

Overall Score

We have collected all the parameters of brokers that are important for trading into different groups for your convenience. The closer the parameter is to the maximum value, the higher the percentage of the group. The overall score is based on all groups’ scores. Now you can see what the strengths of the broker are and where are their weaknesses. Not only to see but also to understand how much it suits your particular needs. If a broker has a GREEN VERIFIED, then the information about its parameters has been received from the broker and been examined by us! GREY NOT-VERIFIED means that information about the parameters of the broker is collected from open sources on the network, BUT it is not confirmed by our tests. RED NOT-VERIFIED means that there is no unambiguous information on this broker in open sources and the specified parameters may differ greatly from the actual ones.

-

Spread:good

-

Number of futures:0

-

Number of currency pairs:50

-

Digits after the dot:5

-

Number of commodities:19

-

Number of cryptocurrencies:1

-

Minimum Deposit:1

-

Number of bonds:0

-

Nuber of indices:12

-

Number of tradable assets:600

-

Leverage:400

-

Number of options:0

-

Number of stocks:450

-

Risk Allocation & Money Management:n/a

-

Autochartist:n/a

-

Trading signals:n/a

-

Automated trading:n/a

-

Robots/Bots trading:n/a

-

Trading Central:n/a

-

Hedging:n/a

-

Trailing SP/TP:n/a

-

Restrictions at the Stop/Limit level:n/a

-

Institutional Account:n/a

-

Swaps:

-

OCO orders:n/a

-

Withdrawal from accounts with open positions:n/a

-

Segregated Account:n/a

-

Trading platform:

-

Guaranteed Limit Orders:n/a

-

Balance protection:n/a

-

Islamic Account:n/a

-

Scalping:n/a

-

Guaranteed Stop Loss:n/a

-

Multi currency accounts:n/a

-

Economic Calendar:n/a

-

One-click trading:n/a

-

E-mail Alerts:n/a

-

News trade:n/a

-

News:n/a

-

Trading from chart:n/a

-

Mobile alerts:n/a

-

Margin Call:n/a

-

Daily market commentary:n/a

-

VPS services:n/a

-

Mobile App:n/a

-

Stop Out Level:n/a

-

Social trading/copy trading:n/a

-

API trading:n/a

-

Verified:n/a

-

Execution audit:n/a

-

Number Of Employees:

-

Regulatory warnings (past 2 years):0

-

Audit:n/a

-

Founded:2000

-

Professional references:n/a

-

Number of Awards:0

-

Publicly traded:n/a

-

Verified address:n/a

-

Independent profile in trusted web portals:n/a

-

Financial reliability audit:n/a

-

Number of offices:0

-

Regulation:

-

Participation in professional unions:n/a

-

Video education:n/a

-

Cent accounts:n/a

-

Webinars:n/a

-

Demo account:n/a

-

Expert advisors:n/a

-

Tutorials:n/a

-

Social media support:n/a

-

24 hours support:n/a

-

Live chat:n/a

-

Email inquires:n/a

-

Phone line:n/a

-

Languages:

-

Commission withdrawals:n/a

-

Instant withdrawals:n/a

-

Deposit Options:

-

Bonus offered:n/a

-

Interest on margin:n/a

-

Not using fee:n/a

-

Commissions:n/a

-

Fees:nan/a

How we calculate

Advantages

Disadvantages

IFC Markets is a brand name for the ICM groups and is a global broker that is known for specialising in a range of different and diverse instruments like CFDs, commodities, ETFs, Indices. It also supports crypto trading but with future’s contracts. The broker offers the mighty MetaTrader 4 and its successors to the traders as the preferred trading platform. It has to be noted that MetaTrader is on the top of the most popular trading platform list.

This review will discuss the broker in detail, and after reading it, the traders can decide for themselves if it is a reliable broker. Because most brokers claim that they are a good broker, but it is rare for them to pull up the facts.

IFC Markets Account types:

Th broker offers different trading accounts across is trading platforms it offers. The base currencies have to be the same across all the accounts. Although, payments made via the NetTradeX platform also accept UBTC payments.

Standard Accounts

The leverage offered in this account ranges from 1:100-1:200 and the minimum deposit is 1000, kept universal for all currencies. The minimum spread is kept at 1.8, and the floating spreads are kept at0.8 pips.

Beginner/Micro Accounts

The leverage offered in this account ranges up to .1:400, and that equities are capped at Either one dollar and euro and a hundred units of the Japanese Yen. nThe fixed spread in this account is kept at 1.8 pips

To open an account with the broker, the traders just have to visit the broker’s website and follow the simple steps that it asks to complete.

Is IFC markets a scam? Regulations:

The IFC markets group was made together in a. firm back in ’06. The firm was then made up of different and regulated subsidiaries that had different web domains for each of them. IFC markets follow an STP protocol with the liquidity provider where the bids directly come from the provider. The financial service provider has spread its service over the globe and offers them in 80 different countries.

The IFC Markets Group was established in 2006, consisting of regulated subsidiaries operating via separate web domains. The broker offers 600+ trading instruments in 18 languages across 80 countries from India and Singapore to Iran, Canada, Armenia and Asia. The company follows an STP model with pricing quotes direct from liquidity providers.

The broker is regulated by the BVI FSC or the British Virgin Island Financial Services Commission. IFC Markets is also at par with the MiFID regulations and has all the transactional authorities by the Labuan Financial Services Authority. This assures that the brokerage does guarantee segregated accounts in the client funds. The Broker happens to provide more than 600 trading assets to the trader. This is more than the industry standards.

The broker is very clear on the part where it tells the traders about the services it offers. Besides, Rome wasn’t built in a day. There are ample examples out there where the broker was registered, and then it took a little more time to get registered. We can say that despite not being registered yet, the broker is not a scam. The broker offers a trading platform that is one of the best in the whole financial market.

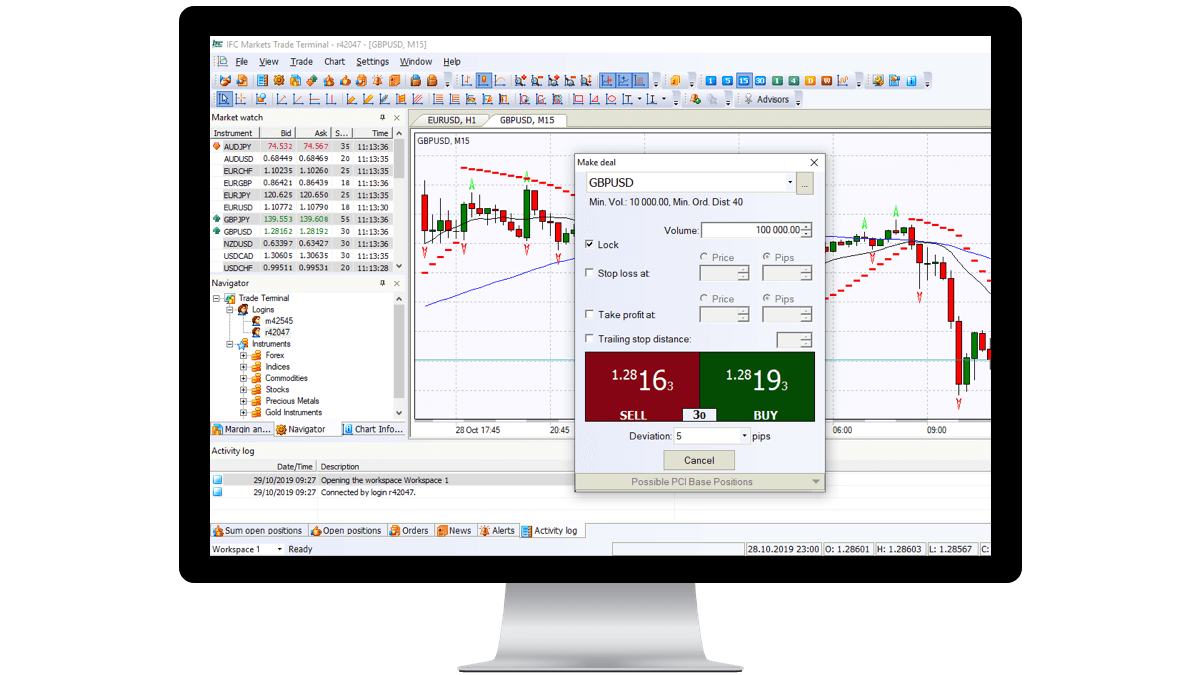

Trading Platforms review:

The broker provides three different trading platforms to the traders for trading. Two out of those are the MetaTrader platforms, and one is the NetTradeX. All three of them are available to download for free from the internet as well as the play store and iOS.

Let’s read about them in detail.

NetTradeX:

The trading platform comes with the option of automated trading. The platform also daunts a portfolio quoting model with the inbuilt PCI technology.

NetTrade X is known for the best technical analysis tools with even better User Interface designs. There is no need for a single person to operate two different accounts for trading in CFDs and Forex. The Risk management and risk warning trigger make the platform even better for novice traders.

MetaTrader 4:

Who doesn’t know about the MetaTrader trading platform? Probably the folks who still think that it is the same as several trading platforms. You see, that is just not true. MetaTrader is the Optimus prime of trading platforms, and the lineage has been out there to protect the traders from different risks that the faulty platforms expose them towards.

The IFC Markets trading is impossible without these platforms saving demo and real trading accounts from the volatility that the market has always been a witness to.

The platform is best for forex trading, but it has a lot of time and proven its efficacy in cfd trading. The Trading tools that the platform provides are more than enough for a trader to book their profits. The way traders perform trading is hugely dependent on the fact that how good the platform is. There are several trading accounts that can be operated from the meta trader platform.

There is no doubt that the MetaTrader lineage has made trading in currency pairs and trading cfds easy for the novice. The platform is downloadable on Windows and Mac devices and is based on the MQL4 programming language.

MetaTrader 5

This successor to the legendary MT4 is very much different from the previous versions of it The platform offers different hedging and netting options. The list of technical indicators is way larger than that of the MT4. The platform also daunts additional time frames and is best suited for ECN trading.

Trading markets and instruments:

The broker offers more than 600 trading instruments to the traders. The commodities sector includes more than 25 of them. The cryptocurrency sector is made up of a lot of different and exciting cryptocurrencies. The list is, of course, incomplete without bitcoin.

The broker offers ETFs on real estate. ETF is arguably the best financial instrument. Forex trading that the broker provides is made up of more than 50 exotic currency pairs that can be traded. The most popular stocks offered by the broker include Nike and Amazon.

The broker also offers to trade on major indices like DJ and NASDAQ. The financial technologies that the broker has provided over the years have come as a boon for the investment business of different individuals. A few trading fees that the broker asks to the traders and the floating spread accounts are better than any other accounts that the other brokers offer.

The financial markets have not seen a better trading account IFC Markets trading account, and there are no second thoughts to that. The IFC Markets website clearly mentions that trading in cfds can be a risky business, but at the same time, it has to be kept in mind that these are the best-suited instruments for advanced traders. as well as anyone

Commission and spreads:

The broker has a strict no policy for commissioned trades while the traders trade in anything other than stock cfds.

The broker clearly mentions the fixed spreads that are charged on different instruments. The minimum spread asked by the broker is 1.8 pips, and that is universal for all accounts. Trading is offered in different currency pairs like the NZDUSD, EURUSD, USDCAD, to name a few, and these currency pairs are also subject to a bit higher pips, ranging to 3 in some cases.

Spreads vary in the cases of different asset classes. Gold, for example, is offered at 80 pips, and DJ is offered at 130 pips. Although the trading platforms can be found with the floating spread accounts bit that is something that as not be worried about

Leverage

The maximum leverage the broker offers is 1:200. That means one dollar. The trader can operate a market of 200 dollars. This is a good move because the novice doesn’t know a lot about leverage and can make horrible financial mistakes when offered a larger exposure. There can also be situations where the traders claim that their loss was amplified because they used leverage. Pay close attention to such people because they are the ones who have really lost their money and mind.

Leverage is a two-way street and should be used with utmost care. One wrong move can fry the profits earned in months of concentrated and careful trading.

Deposits, withdrawals and minimum deposit:

The broker offers deposits and withdrawals in a lot of different base currencies. Most of the trading fees are directly associated with the payment method rather than the commission that a lot of brokers ask for.

The minimum deposit is different for each of the trading account types, the lowest being $1. This is more than perfect for novice traders. The Bank transfer usually takes two to three working days and the minimum deposit. There are a lot of different options to withdraw money. The separate account types offer other instruments, and they are good enough for compelling instruments crypto futures.

The custom indicators offer a great deal when it comes to saving up some money. The broker provides bank cards that can work up to a $100 deposit, and Specific wallers like Neteller, skrill, WebMoney etc., are also there to help the traders with their trading needs. The processing time of withdrawals varies by the variation in the payment method. The broker offers unlimited withdrawal requests to be made, and there is no fee charged for that.

Trading based educational material:

The broker offers a wide range of trading material that the traders can use to benefit and become a better version of traders. The educational material that the brokers provide has to be good enough so that the traders can constantly learn from it and then excel in the field. The material offered by IFC Markets is at par with the industry standards and includes on-demand videos with a wide range of articles and a daily updated economic calendar.

Customer Support

The broker offers a live chat that can be accessed via the website. The traders can also reach the broker via email ([email protected]). The broker can be contacted online from its website and the telephone number as follows: UK +442039661649, Canada +16136864362

Bottom Line:

The broker seems to be regulated, and it looks like IFC Markets offers the best out of everything they can. This IFC Markets review has covered almost all the points that are important. The only investment advice left on our end to provide you with is that make sure you know what you’re putting yourself into.