Anzo Capital

-

Trading conditions49%

-

Platforms and tools62%

-

Credibility10%

-

Education83%

-

Support57%

-

Fees and payments7%

-

Users choice57%

Anzo Capital is one of the fastest growing online Contracts For Differences (CFD) and FX brokers across the globe, providing margin trading in financial derivatives. For two years running in both 2020 and 2021, the firm took home two distinguished awards — “Best Trade Execution Platform (APAC)” and “Excellence in Client Funds Security (APAC)” at the Global Brands Awards. Anzo Capital offers all traders a world-class trading environment with attractive features such as high leverage, low spreads, low trading fees, wide range of payment solutions, and quality client support. The organisation prides itself as a premier destination for traders with key values on integrity, trustworthiness and service excellence.

Overall Score

We have collected all the parameters of brokers that are important for trading into different groups for your convenience. The closer the parameter is to the maximum value, the higher the percentage of the group. The overall score is based on all groups’ scores. Now you can see what the strengths of the broker are and where are their weaknesses. Not only to see but also to understand how much it suits your particular needs. If a broker has a GREEN VERIFIED, then the information about its parameters has been received from the broker and been examined by us! GREY NOT-VERIFIED means that information about the parameters of the broker is collected from open sources on the network, BUT it is not confirmed by our tests. RED NOT-VERIFIED means that there is no unambiguous information on this broker in open sources and the specified parameters may differ greatly from the actual ones.

-

Spread:visible_only_for_verified_brokers

-

Number of futures:0

-

Number of currency pairs:45

-

Digits after the dot:

-

Number of commodities:4

-

Number of cryptocurrencies:3

-

Minimum Deposit:100

-

Number of bonds:0

-

Nuber of indices:13

-

Number of tradable assets:4

-

Leverage:1000

-

Number of options:0

-

Number of stocks:30

-

Risk Allocation & Money Management:n/a

-

Autochartist:no

-

Trading signals:yes

-

Automated trading:yes

-

Robots/Bots trading:yes

-

Trading Central:no

-

Hedging:yes

-

Trailing SP/TP:yes

-

Restrictions at the Stop/Limit level:no

-

Institutional Account:yes

-

Swaps:visible_only_for_verified_brokers

-

OCO orders:no

-

Withdrawal from accounts with open positions:yes

-

Segregated Account:yes

-

Trading platform:mt4mobile_platformweb_platform

-

Guaranteed Limit Orders:no

-

Balance protection:n/a

-

Islamic Account:no

-

Scalping:yes

-

Guaranteed Stop Loss:n/a

-

Multi currency accounts:yes

-

Economic Calendar:yes

-

One-click trading:yes

-

E-mail Alerts:yes

-

News trade:yes

-

News:yes

-

Trading from chart:yes

-

Mobile alerts:no

-

Margin Call:yes

-

Daily market commentary:yes

-

VPS services:yes

-

Mobile App:yes

-

Stop Out Level:yes

-

Social trading/copy trading:no

-

API trading:no

-

Verified:n/a

-

Execution audit:no

-

Number Of Employees:120

-

Regulatory warnings (past 2 years):0

-

Audit:yes

-

Founded:2016

-

Professional references:n/a

-

Number of Awards:8

-

Publicly traded:no

-

Verified address:n/a

-

Independent profile in trusted web portals:yes

-

Financial reliability audit:no

-

Number of offices:

-

Regulation:ifsc svgfsa asic

-

Participation in professional unions:no

-

Video education:yes

-

Cent accounts:no

-

Webinars:yes

-

Demo account:yes

-

Expert advisors:no

-

Tutorials:yes

-

Social media support:yes

-

24 hours support:yes

-

Live chat:yes

-

Email inquires:yes

-

Phone line:yes

-

Languages:English,Chinese,Korean,Japanese,Thai,Vietnam,BahasaIndonesia

-

Commission withdrawals:no

-

Instant withdrawals:yes

-

Deposit Options:visamastercardskrillnetellerweb_moneywire_transfersticpayfasapayamerican_expresscryptocurrencym_pesa

-

Bonus offered:yes

-

Interest on margin:yes

-

Not using fee:no

-

Commissions:n/a

-

Fees:yesyes

How we calculate

Advantages

Disadvantages

Anzo Capital is one of the fastest growing online Contracts For Differences (CFD) and FX brokers across the globe, providing margin trading in financial derivatives. It offers all traders a world-class trading environment with attractive features such as high leverage, low spreads, low trading fees, wide range of payment solutions, and quality client support. The organization prides itself as a premier destination for traders with key values on integrity, trustworthiness, and service excellence.

Overview of Anzo Capital

Anzo Capital offers all traders a world-class trading environment with attractive features such as high leverage, low spreads, low trading fees, a wide range of payment solutions, and quality client support. The organization prides itself as a premier destination for traders with key values on integrity, trustworthiness, and service excellence.

Pros & Cons

Pros

- Leverage of up to 1:1000 lets you trade on Forex, Spot Oil, Precious Metals, Cryptocurrency, Stocks CFD and Indices

- High leverage and low spreads which means the low trading cost

- Low startup capital, along with low trading commissions, and no transaction fees or hidden costs

- No restrictions on the trading strategies. Scalping is allowed

- Enjoys direct market access with deep liquidity, swift execution and better pricing based on STP & ECN models

- Provides excellent trading environment, at low costs to ensure our clients never miss out on good investment opportunities

- Offers complete forex education with useful trading signals, strategies, tips and techniques from our Global Head of Research and Analysis

- Comprehensive analysis with trade insights to guide & keep veterans and new traders informed

- Multi-licensed broker, regulated by global financial authorities — SVG, ASIC, and IFSC, ensure that our clients’ funds remain secure and protected

- 24/7 customer support available in 8 languages – English, Korean, Chinese, Vietnamese, Bahasa Indonesia, Japanese, Thai and Spanish

- Fast deposit and withdrawals with no processing fee

- Quick and easy account opening

Cons

- Not available in the US

Regulations

The activities of Anzo Capital are authorized and regulated by the International Financial Services Commission (IFSC) of Belize, St Vincent & The Grenadines Financial Services Authority (SVG FSA), and the Australian Securities & Investments Commission (ASIC). In Australia, Anzo Capital PTY Limited (ACN 630 865 039) is an Australian Financial Services Authorised Representative of Focus Markets Pty Ltd (ASIC License number: 514425). For activities outside of Australia, Anzo Capital Limited is regulated by IFSC, registration number IFSC 000331/172; while Anzo Capital (SVG) LLC is regulated with SVG FSA (Company Number: 308 LLC 2020). As a licensed broker, Anzo Capital adheres to strict regulatory requirements in accordance with best business practices to ensure that all client funds are fully protected.

As of 29 March 2021, ASIC has tightened its regulations, restricting leverage to a maximum of 1:30 on CFD products for all retail clients. The product intervention order will also introduce changes to trading conditions—negative balance protection to limit client losses, prohibition of certain incentive offerings such as credits or rebates, and the standardization of margin close-out ratios before a client’s investment is lost.

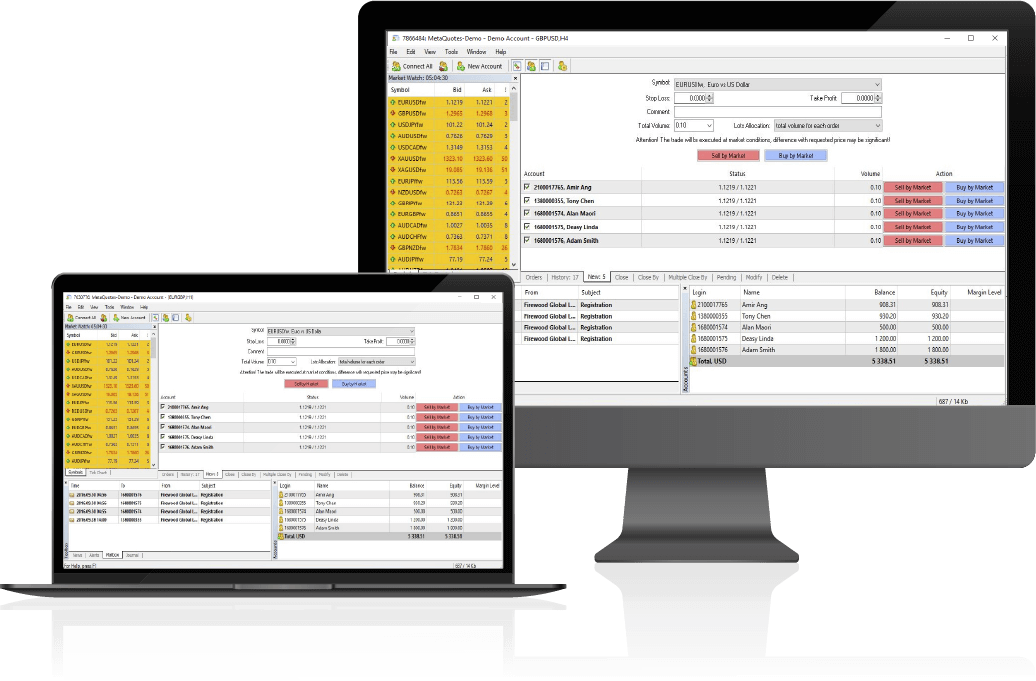

Trading Platform

At Anzo Capital, trading is carried out on the MetaTrader 4 (MT4) platform, the world’s recognized trading platform. It offers traders a fully customizable system, a user-friendly interface, and a suite of technical analysis tools. Clients can also enhance their trading journey through the use of Expert Advisors for automated trading strategies.

Trading on MT4 is available on a desktop, web browser, and mobile devices as well, so you can experience the convenience of accessing your trades on the go, anytime anywhere.

For professional traders and Money Managers, trading is available on MT4 Multi Terminal and Multi Account Manager (MAM) software.

Markets and Products:

Anzo Capital provides margin trading on an extensive host of products including FX, Precious Metals, Energies, Crypto, Indices and Stocks CFD.

Traders can also enjoy competitive global access, low spreads, deep liquidity and high leverage of up to 1:1000 (on FX instruments).

Account Types

Clients can choose between three types of accounts to open — Individual, Joint or Corporate accounts. Trades are executed based on STP or ECN model with a strict no-dealing desk policy.

STP Account:

- Min. Deposit: 100 USD

- Leverage: Up to 1:1000*

- Minimum Lot Size: Micro-Lot (0.01)

- Lots Increment: 0.01

- Margin Call: 80%

- Stop Out: 50%

- No Commission

- Supports EA

- Free trading guides, trading signals, market news and research

- 24/5 online technical support

- Available for Individual and Joint accounts only

ECN Account:

- Min. Deposit: 500 USD

- Leverage: Up to 1:500*

- Minimum Lot Size: Micro-Lot (0.01)

- Lots Increment: 0.01

- Margin Call: 80%

- Stop Out: 50%

- Commission: $7USD/lot Round Turn

- Supports EA

- Free trading guides, trading signals, market news and research

- 24/5 online technical support and dedicated account manager

- Available for Individual, Joint, and Corporate accounts

Opening an account with Anzo Capital is simple and can be completed within an hour.

Research & Education

Anzo Capital provides all clients with research materials such as Trading Signals, Daily Insights, Market Analysis & Reviews and Podcasts. Trading and Forex Guides are available on the Client Portal as well.

In addition, you will find other useful trading tools like the Economic Calendar, Forex Calculators, Trading Signals, including MQL5 and VPS.

At Anzo Capital, we want to give our clients the best environment for trading success. That is why we have worked hard to build the necessary infrastructure to offer Virtual Private Server (VPS). With the powerful connectivity that VPS provides, your orders will be executed instantly giving you the best price possible and reducing unnecessary losses. With ultra-fast order execution, you are able to get in and out at just the right moment.

Demo

Trading involves a lot of money and risk, thus one should not make the decision without any trial run. For new traders, Anzo Capital offers a free 30-day MetaTrader 4 demo trading account to practice trading with:

- STP Account

- Deposit Up to $100,000

- Leverage Level Up to 1:1000

The online forex demo account allows an insight into how the whole world is buying and selling commodities. This involves a simple process and minimal information like name, address and a working phone number to start an online forex demo. These accounts do not require any real money deposit and thus provide a great opportunity to learn about the dealing of these accounts and the knowledge of the market. This is a great platform that allows a lot of learning without having to spend single money on anything. It is completely risk-free.

Opening an Account

With our fast account opening process, you can easily set up and fund your trading accounts straight from our comprehensive Client Portal.

Select from multiple funding methods when depositing or cashing out your profits, and enjoy peace of mind with real-time transactions and transparent conversion rates. The client portal also contains useful resources such as trading and user guides to enhance your trades and help you along your investment journey.

Anzo Capital takes only 2 business days to process once we receive your application with the required documents.

Deposits & Withdrawals

To ensure that traders do not miss out on good investment opportunities, all deposits and withdrawals are real time and can be completed within 3 hours, without any processing fees.

On top of quick and easy funding, Anzo Capital also provides traders the liberty to deposit and withdraw from a wide range of payment solutions. This way, clients can access their funds the way they prefer, giving them peace of mind.

Here are some of the deposit and withdrawal methods available with Anzo Capital:

- Credit Card (VISA, Mastercard, JCB, AMEX)

- Skrill

- Neteller

- STICPAY

- M-Pesa

- Webmoney

- Online Banking (THB, VND, PHP, IDR, CNY, NGN & ZAR)

- Cryptocurrency (BTC & USDT)

- Fasapay*

- Grabpay*

- GCash*

- Dragonpay*

*selected territories

Anzo Capital adheres to stringent guidelines by the authorities, which include Anti-Money Laundering policies to protect all clients. We do not accept third party deposits or withdrawal requests.

Customer Support

Live Chat Support

Support Email: [email protected]

As proponents of client satisfaction and service excellence, Anzo Capital has an efficient and dedicated support team that clients can reach out to via Live Chat and email, 24/5, Monday to Friday.

In addition to our customer service team, clients can also seek assistance and support from exclusively paired account managers.

Awards & Accolades

Anzo Capital has come a long way and is honored by the multiple awards and accolades we have been conferred over the years. Each achievement is a testament of our commitment to service excellence, as well as an affirmation of our client’s trust and support.

For two years running in 2020 and 2021, the firm took home two distinguished awards — “Best Trade Execution Platform (APAC)” and “Excellence in Client Funds Security (APAC)” at the Global Brands Awards. Other awards include:

- Global Real Trading Contest 2019: Best Client Service of the Year

- 22nd International Investment and Financing Expo of Shanghai 2018: Fastest Growing Forex Broker

- The 2nd Zheng Zhou Finance Expo: Fastest Growing Forex Broker

- Money Trip 2018: Best Forex Broker

The deposit method of the YaMarkets is via Bank Wire, VISA, MasterCard, AstroPay, Bitcoin, Local Bank Deposits, Local Exchangers, PayPal, PerfectMoney, etc. The headquarters of the YaMarkets is located at Suite 305, Griffith Corporate Centre, Kingstown P.O. Box 1510, Beachmont Kingstown St. Vincent and the Grenadines.

The brokerage firm offers customer support service to the investors which is helpful for the traders to solve their problems regarding trading in the market. It is one of the best online brokers in the market which provides the best services and functions to investors.

Is YaMarkets Scam: Regulations

It is the legit broker in the market regulated and sanctioned by the Vanuatu Financial Services Commission (VFSC). The investor’s money is completely secure and safe with YaMartkets because the broker will use the upgraded technology for trading.

Before starting trading with YaMarkets the traders need to deposit the initial amount of $10. After that, the brokerage firm doesn’t charge any commission on all the trading accounts except ECN. The withdrawal process of the YaMarkets is very simple; a trader only needs to submit a withdrawal request then the broker initiates a request within the working hours.

The broker offers the maximum leverage of 1:1000 to the professional investors of YaMarkets.

YaMarkets Trading Account Types

The brokerage firm offers four types of trading accounts, and each account has some advanced level of features and functions which is grateful for the investors.

Ultimate Trading Account

- To start trading with YaMarkets the minimum deposit is required $10.

- Minimum trading volume 0.01

- The broker offers a Swap-free Account.

- In the Ultimate trading account, the Spread starts from 1.8 pips.

- The broker doesn’t charge any commission while trading in the ultimate reading account.

- The maximum leverage offered by the broker is 1:500.

- The Account Currency type is USD.

- The trader has a Margin call of 70%.

- A trader has a Stop Out option of 50%.

- Instant Execution.

Standard Trading Account

- Before starting trading with YaMarkets, the minimum deposit required is $500.

- Minimum trading volume 0.01

- The broker offers a Swap-free Account.

- In the Ultimate trading account, the Spread starts from 1.5 pips.

- The broker doesn’t charge any commission while trading in the ultimate reading account.

- The maximum leverage offered by the broker is 1:500.

- The Account Currency type is USD.

- The trader has a Margin call of 70%.

- A trader has a Stop Out option of 50%.

- Instant Execution.

Royale Trading Account

- The minimum deposit is $2500 to start trading with YaMarkets.

- Minimum trading volume 0.01

- The broker offers a Swap-free Account.

- In the Ultimate trading account, the Spread starts from 1.0 pips.

- The broker doesn’t charge any commission while trading in the ultimate reading account.

- The maximum leverage offered by the broker is 1:300.

- The Account Currency type is USD.

- The trader has a Margin call of 70%.

- A trader has a Stop Out option of 50%.

- Instant Execution.

ECN Trading Account

- The minimum deposit is $5000 to start trading with YaMarkets.

- Minimum trading volume 0.10

- The broker offers a Swap-free Account.

- In the ECN trading account, the Spread starts from0.1 pips.

- The broker doesn’t charge any commission while trading in the ECN trading account.

- The maximum leverage offered by the broker is 1:200.

- The Account Currency type is USD.

- The trader has a Margin call of 70%.

- A trader has a Stop Out option of 50%.

- Instant Execution.

YaMarkets Account Opening

It is one of the best online brokers in the market. However, to start trading with YaMarkets, a trader needs to follow a few essential steps.

- In the beginning, a trader needs to apply online on the official website of Yamarket then fill the application form in which they put the necessary details such as name, age, address, country, etc.

- Then the trader gives the answers to the questionnaire, which is related to the trading plans and goals.

- It is one of the most important steps in which an investor needs to verify their trading account with the help of a government ID card because it takes some time to verify their trading account.

- In the end, deposit the initial amount of money and start trading with YaMarkets.

YaMarkets Trading Platform

YaMarkets offers two types of the trading account as MetaTrader 4 and MetaTrader 5. Every trading platform has some unique functions which are beneficial for the investors.

MetaTrader 4 Trading platform

It is the best trading platform because it is easy to handle and controlled by investors. In addition, MetaTrader 4 platform has all the features which are essential to predict the future market of the assets.

What are the main features of the MetaTrader 4 trading platform?

- The brokerage firm offers tradable assets such as forex, cryptocurrency, Indices, Metals, Indices, etc.

- The platform supports various types of languages.

- MetaTrader 4 platform has all tools and indicators which are essential to trade.

- Offers a variety of charts for trading.

MetaTrader 5 Trading platform

It is the advanced level of the trading platform in the market because if we compare both the trading platforms, then MetaTrader 5 has more variety of tools and indicators for trading.

What are the main features of the MetaTrader 5 trading platform?

- A trader can trade on a variety of CFDs assets.

- The platform supports VPS.

- It has some superior charting systems.

- A trader gets access to the market news and data.

- The broker offers educational material which is helpful to get information about the market.

YaMarkets Trading Instruments

The brokerage firms offer CFDs instruments for trading. Therefore, a trader can earn a higher profit with YaMarkets.

Forex

- Spreads from 0.0 pips.

- Access to 60+ Currency Pairs.

- 0.20s Average execution speed.

- All trading strategies enabled.

- Leverage up to 1:500

Cryptocurrency

- Invest in CFDs on 26 Cryptocurrencies.

- Trade at any time convenient for you.

- Start your trading with just 10USD.

- Invest via modern platforms.

YaMarkets Commission & Spreads

- The brokerage company doesn’t charge any commission while trading.

- Only the ECN trading account holder pays the commission on trading.

- The Spread is fluctuating within a second.

- The broker charges the inactivity fee if an investor is inactive in the market.

YaMarkets Leverage

The brokerage firms offer a maximum leverage of 1:1000 to the professional investors and 1:30 to the retail investors.

YaMarkets Deposit and Withdrawal

- A trader can deposit an unlimited amount of money into the trading account for trading.

- The broker doesn’t charge any commission while depositing the money.

- The payment option of the YaMarkets is via Bank Wire, VISA, MasterCard, AstroPay, Bitcoin, Local Bank Deposits, Local Exchangers, PayPal, PerfectMoney, Skrill, VoguePay.

- The broker charges the withdrawal fee from the traders if the trader withdraws a large amount of money.

YaMarkets Educational and Research Support

The brokerage firm offers a wide variety of educational and research material for investors. It is helpful for the investor to gain knowledge about the market and predict the future situations of the asset.

A trader understands the market properly then practices on the demo account first and selects the best trading strategy for trading which is used in the real trading account.

Here is the list of Educational and Research support:

- Calculator

- Educational Video

- Economic Calendar

- Daily Trading Signals

YaMarkets Customer Support

The broker provides customer support service for solving problems. The employees of YaMarkets have good experience to solve the investor problem. If the problem is not solved by customer support, it will be transferred to the higher executive.

Address: Suite 305, Griffith Corporate Centre, Kingstown P.O. Box 1510, Beachmont Kingstown St. Vincent and the Grenadines.

Email: [email protected]

Phone number: +357 22030234

Final Verdict

YaMarkets is authorised and approved by the Vanuatu Financial Services Commission (VFSC). The investor of this firm is giving positive feedback towards the broker. This is the only broker in the market which provides the best trading tools and indicators.

Why Trade with YaMarkets?

- VFSC regulates it.

- A trader can trade 80+ CFDs assets.

- The brokerage company offers a demo account for the investors.

- The broker provides a customer support service to traders.

- Provide a variety of tools and indicators.